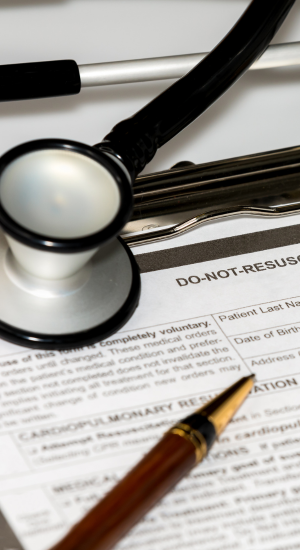

Healthcare Planning

Who will take care of you if you are unable to care for yourself?

As the oldest baby boomers begin to wind through their 70’s, one of the biggest concerns may not be outliving income but outliving good health. Elder care planning is the act of planning ahead so that life’s transitions are as smooth as they can possibly be. Healthcare costs during retirement are increasing and it’s important that you plan appropriately so that you don’t lose a significant portion of your savings to healthcare.

Even if you have not planned ahead, there are many techniques we can use to lessen or eliminate the burden on your financial assets. We can help evaluate your situation and determine if purchasing a long-term care insurance policy may be the right move to help you feel confident in your financial future.

You never know what’s around the corner.

We can help prepare you financially for long-term care services you may need so that a health crisis doesn’t derail your retirement savings. Considering that you could have to reduce your financial means before Medicaid will pay for long-term care and neither your employer group health insurance nor major medical insurance will cover long-term care, you may want to consider planning ahead for these potential expenses.

We can discuss a variety of options for planning for long-term care costs including:

- Traditional long-term care insurance

- Hybrid long-term care life policies

- Paying with a Health Savings Account

- Effect on your estate and legacy plan